When you start your business, time and money may be in short supply. Your top priorities may be to find customers and deliver a great product or service. So you may not have automated administrative tasks like bookkeeping and accounting when you open your doors.

Breathe new life into your CASHFLOW tabletop experience! Set aside your pencil and your paper financial statements and let the app crunch the numbers for you! This app will:. Auto-fill your profession’s salary, savings, and debt. Perform all calculations of the financial statement for every Small/Big Deal, Doodad, and Market card. Click the title 'Robert Kiyosaki Cashflow 101 and 202' to download the torrent file 3. It will automatically open uTorrent, then you will be given an option which files are to be downloaded. Cashflow 101 game sheets home cash flow spreadsheet 1562660 for everyone excel budget Golagoon. Cashflow 101 Game Sheets Home Cash Flow Spreadsheet 1562660. Professional Excel Templates for Excel – Spreadsheet Store We’ve selected the best professional excel templates to improve your business planning and management on spreadsheet examples. You’ll fin d profess ional excel templates spreadsheets with cash flow dashboards, inventory management charts, Balance Sheet Statement reports, samples. The spreadsheet provides separate tabs for a current cash flow statement, as well as 12-month cash flow and three-year cash flow projections. Enter year-by-year operations, investing activities, and financing details to see your year-over-year net increases or decreases.

Many small business owners use an Excel accounting template when they start operations. Most people are familiar with Excel, and using the application is straightforward. But keep in mind that Excel bookkeeping is not a solution for a growing business. As your business grows, you’ll need to post more accounting transactions. And bookkeeping in Excel can lead to errors and inefficiency.

In the meantime, you’ll still need to understand the accounting process and how you can complete each task using Excel accounting. You’ll need to set up accounts, post transactions, and create financial statements using Excel. Let’s look at an example.

Centerfield Sporting Goods opened on January 1, 2020. They’re using an Excel bookkeeping template to manage the business. The first thing they’ll need to do is create a chart of accounts.

How to start a chart of accounts

The chart of accounts lists every account number and the account’s description. Balance sheet accounts, such as cash and accounts receivable, are listed first, followed by income statement accounts. Centerfield uses one revenue account (#6000 sales) in the income statement and several expense accounts.

Centerfield manufactures and sells baseball gloves. The business uses the cost of sales accounts for both materials and labor. They can add, remove, and change accounts as needed.

Once you build a chart of accounts in an accounting spreadsheet, create a separate Excel document to post journal entries.

How to post transactions using journal entries

A journal entry is a record of each accounting transaction listed in chronological order. Bookkeepers post transactions using a journal entry.

The journal includes the journal entry number, accounts, dollar amounts, and a description of each entry. Journal entries include debits and credits that determine where to post a particular dollar amount in the entry.

What is a debit in accounting?

Post debit entries on the left side of each journal entry. Asset and expense accounts increase with a debit entry, with some exceptions. In entry No. 1, inventory (an asset account) increases with a $10,000 debit.

What is a credit in accounting?

Post credit entries on the right side of each journal entry. Liability and revenue accounts increase with a credit entry, with some exceptions.

Accounts payable, for example, is a liability account that increases with a credit. In entry No. 2, accounts payable decreases with a debit when Centerfield pays cash to remove a payable balance.

The total dollar amount you post to each debit account must equal the total dollar amount of credits. Each journal entry has an equal amount of debit and credit dollar amounts. The total debits and credits for the partial listing total $20,000. The number of debit and credit entries, however, may be different.

Using the balance sheet formula to post journal entries

The balance sheet formula (or accounting equation) determines whether you use a debit or a credit for a particular account. The balance sheet is one of the three basic financial statements that every business owner should analyze to make financial decisions. Business owners also review income statements and cash flow statements.

A balance sheet reports your business’s assets, liabilities, and equity as of a specific date.

- Assets are what your business owns. Assets are the resources you use to produce revenue.

- Liabilities are what your business owes to other parties. Liabilities include accounts payable and long-term debt.

- Equity is the difference between assets and liabilities. You can think of equity as the true value of your business.

A balance sheet formula connects the balance sheet components. Add liabilities to equity to determine your assets.

Assets = liabilities + equity

You can use the formula to create financial statements. But assets must stay balanced with liabilities and equity.

Assume, for example, that a business issues a $10,000 bond and receives cash. The company posts a $10,000 debit to cash (an asset account) and a $10,000 credit to bonds payable (a liability account).

On your balance sheet, you’d add the $10,000 increase in liabilities to the $0 change in equity to get a $10,000 assets increase.

$10,000 assets increase = $10,000 increase liabilities + $0 change equity

Accounting software ensures that each journal entry balances the formula and total debits and credits.

How to post journal entries using Excel

Follow these steps to create accounting templates for your journals each month:

- Copy and paste your chart of accounts into the spreadsheet.

- Set up the column headings for date, account number, account title, etc.

- Add rows to the document each time you need to post a journal entry.

- Copy and paste the account numbers and account titles from the chart of accounts into the entry.

Use formulas to ensure that total debits equal total credits. Add a total formula that tracks the total dollar amount of debits and credits for all journal entries. Now, you’ve created your journal entry for your general ledger.

How to use the general ledger to create financial statements

A company’s general ledger is a record of every transaction it posts throughout its lifetime, including all journal entries. Business owners and accounting professionals use the data in the general ledger to create financial statements.

General ledgers sort transactions by account. Each account lists the journal entries that posted activity to the account during a particular month. General ledgers provide the date, journal entry, and the entry description, along with the debit or credit amount and the ending balance.

It’s important to note the cash general ledger page only lists the cash portion of each journal entry. Journal entry No. 1 only lists the $10,000 reduction (credit) in cash. The inventory increase (debit) is listed in the inventory general ledger but not in the cash general ledger.

The benefit of the general ledger is that you can review every journal entry that impacted a particular account. Unfortunately, creating a general ledger using Excel is time-consuming. And a large number of data entries may increase the risk of error.

How to manage a general ledger using Excel

Use the column headers that you see in the Centerfield general ledger example to set up a general ledger template for each account in your chart of accounts.

- At the beginning of each month, post each balance sheet account’s beginning balance in a blank general ledger template. Income statement balances are adjusted to zero at the end of each month.

- Each time that you post a journal entry, post the activity to the general ledger. If you post a journal entry that impacts cash and inventory, you also post the activity to those accounts in the general ledger.

- At the end of the month, calculate the ending balance for each account. Use the ending balances in the general ledger to create the trial balance.

How to create a trial balance in Excel

The trial balance is a listing of each account used to post transactions and the current account balance. Follow these steps to create a trial balance in Excel:

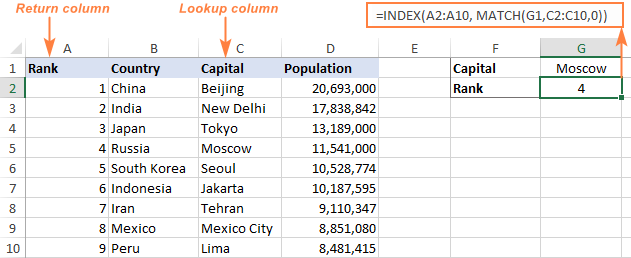

- Take the account numbers and descriptions from the chart of accounts and copy the date into a new spreadsheet.

- Add a debit and credit column next to each account. Post each account’s ending balance from the general ledger into the spreadsheet.

- Total the debits and credits for all accounts. If you’ve posted journal entries and general ledger activity correctly, total debits should equal total credits.

If total debits and credits don’t balance, check each journal entry and verify you posted the data to the general ledger correctly. If you still have an error, check the formulas in your general ledger spreadsheet. Once you have an accurate trial balance, you’re ready to generate financial statements.

How to generate financial statements in Excel

The most useful financial statements are income statements and balance sheets. The statement of cash flow is also one of the basic financial statements. But it can be challenging to generate in Excel. As your business grows, you can use software to produce all three statements. If you’re using Excel, stick with the income statement and balance sheet.

Create an Excel template and use it to generate the income statement each month. Keep the formulas for the subtotals so that you can check your work. Post the account balances from your trial balance.

How to post net income in Excel

You won’t find net income listed in the chart of accounts. Net income in the income statement increases equity (account No. 4800), which is a balance sheet account. When you produce the income statement, net income subtracts total expenses from total revenue. You’ll use net income in the balance sheet.

Create an Excel template and use it to generate the balance sheet each month. Keep the formulas for the subtotals so that you can check your work. Post the account balances from your trial balance.

Net income from the income statement increases equity in the balance sheet. This is a big source of confusion for small business owners, so you may get help from an accountant if you’re using Excel. Ask your accountant to verify that you’ve added net income to the equity account correctly.

How to close the accounts in Excel

Balance sheet accounts are permanent. Income statement accounts are temporary. So you can “close” income statement accounts to the net income.

Net income is the net impact of all revenue and expense transactions for the month. When you post the net income balance to equity in the balance sheet, the revenue and expense accounts are adjusted to zero. On the first day of the next month, the income statement accounts start with zero balances.

Balance sheet accounts, on the other hand, are permanent accounts. The balances carry forward from one month to the next.

Streamline your accounting and bookkeeping processes

Accounting spreadsheets require manual entry, so your risk of error is high. Business owners who use spreadsheets may use an outdated version of the program and risk losing documents altogether. And if spreadsheet links contain errors, your data may be incorrect.

Use QuickBooks to save time and increase the accuracy of your accounting records. If you need a real-time spending tracker, select from the expense reports available. Then scan receipts and other source documents and attach them to journal entries. Use QuickBooks to download your bank statements and credit card activity into your accounting records. You’ll save time and reconcile your bank account faster.

With accounting software, you can process more transactions in less time. Make the switch to accounting software, so you’re ready to take on more business. Compare QuickBooks Online to spreadsheets.

—

This content is for information purposes only and should not be considered legal, accounting or tax advice, or a substitute for obtaining such advice specific to your business. Additional information and exceptions may apply. Applicable laws may vary by state or locality. No assurance is given that the information is comprehensive in its coverage or that it is suitable in dealing with a customer’s particular situation. Intuit Inc. does not have any responsibility for updating or revising any information presented herein. Accordingly, the information provided should not be relied upon as a substitute for independent research. Intuit Inc. does not warrant that the material contained herein will continue to be accurate, nor that it is completely free of errors when published. Readers should verify statements before relying on them.

Multipart article

by Andy Marker on May 08, 2017

A cash flow statement, also referred to as a statement of cash flows, shows the flow of funds to and from a business, organization, or individual. It is often prepared using the indirect method of accounting to calculate net cash flows. The statement is useful for analyzing business performance, making projections about future cash flows, influencing business planning, and informing important decisions. The term “cash” refers to both income and expenditures and may include investments and assets that you can easily convert to cash. By conducting a cash flow analysis, a business can evaluate its liquidity and solvency, compare performance among accounting periods, identify cash flow drivers to support growth, and plan ahead to maintain a positive cash position.

Below you’ll find a collection of easy-to-use Excel templates for accounting and cash flow management, all of which are fully customizable and can be downloaded for free.

Elements of a Cash Flow Statement

A cash flow statement is typically divided into the following sections to distinguish among different categories of cash flow:

- Operating Activities: Cash flows in this section will follow a company’s operating cycle for an accounting period and include things like sales receipts, merchandise purchases, salaries paid, and various operating expenses.

- Investing Activities: Some examples of investing activities include buying or selling assets, making loans and collecting payments, and generating cash inflows or outflows from other investments.

- Financing Activities: This section may include activities such as receiving money from creditors or shareholders, repaying loans and paying dividends, and selling company stock, as well as other activities that impact equity and long-term liabilities.

A statement of cash flows can summarize information for any accounting period, but if you’re starting a new business or planning for the months ahead, creating a cash flow projection can help you anticipate how much money your business will have coming in and going out during a future time frame.

Creating a Cash Flow Forecast

Cashflow 101 202 Excel Spreadsheets 2016

Projecting future cash flows can give you greater financial control, provide a deeper understanding of a company’s performance, help identify shortfalls in advance, and support business planning so that activities and resources are properly aligned. New businesses trying to secure a loan may also require a cash flow forecast.

In order to set yourself up for success, it’s imperative to be realistic when forecasting cash flows. You can build your projections on a foundation of key assumptions about the monthly flow of cash to and from your business. For instance, knowing when your business will receive payments and when payments are due to outside vendors allows you to make more accurate assumptions about your final funds during an operating cycle. Estimated cash flows will always vary somewhat from actual performance, which is why it’s important to compare actual numbers to your projections on a monthly basis and update your cash flow forecast as necessary. It’s also wise to limit your forecast to a 12-month period for greater accuracy (and to save time). On a monthly basis, you can add another month to create a rolling, long-term projection.

A cash flow forecast may include the following sections:

- Operating Cash: The cash on hand that you have to work with at the start of a given period. For a monthly projection, this is the cash balance available at the start of a month.

- Revenue: Depending on the type of business, revenue may include estimated sales figures, tax refunds or grants, loan payments received or incoming fees. The revenue section covers the total sources of cash for each month.

- Expenses: Cash outflows may include your salary and other payroll costs, business loan payments, rent, asset purchases, and other expenditures.

- Net Cash Flow: The closing cash balance, which reveals whether you have excess funds or a deficit.

Keep in mind that while many costs are recurring, you also need to consider one-time costs. Additionally, you should plan for seasonal changes that could impact business performance, and upcoming promotional events that may boost sales. Depending on the size and complexity of your business, you may want to delegate the responsibility of creating a cash flow forecast to an accountant. However, small businesses can save time and money with a simple cash flow projections template.

Excel Bookkeeping and Cash Flow Templates

To help you get started creating a cash flow statement or forecast, we’ve included a variety of customizable templates that you can download for free. Simply adjust your chosen template to fit your specific goals and the intended audience. Each template offers a clean, professional design and is intended to save you time, boost efficiency, and improve accuracy. Just enter your financial data, and the templates will perform automatic calculations for you to analyze. By combining your cash flow statement with a balance sheet, income statement, and other forms, you can manage cash flow and get a comprehensive understanding of business performance. Smartsheet offers additional Excel templates for financial management, including business budget templates.

Accounts Payable Template

This accounts payable template tracks suppliers, order numbers, and amounts due to help you manage payments and due dates. Easily organize ordering stock or supplies from multiple vendors with this template for greater efficiency and fewer errors.

Download Accounts Payable Template

Excel | Smartsheet

Accounts Receivable Template

Don’t let balances owed to your business slip through the cracks. This template accounts receivable template lists customers, invoice tracking details, amounts due, and outstanding balances. Keeping track of these accounts can inform your collections process by helping you quickly identify which overdue payments have aged significantly.

Download Accounts Receivable Template

Excel| Smartsheet

Balance Sheet Template

A balance sheet provides a summary of financial health in a single, brief report. With this balance sheet template, you can assess the financial standing of a business by examining assets, liabilities, and equity. Business owners can use it to evaluate performance and communicate with investors.

Download Balance Sheet Template

Excel | Smartsheet

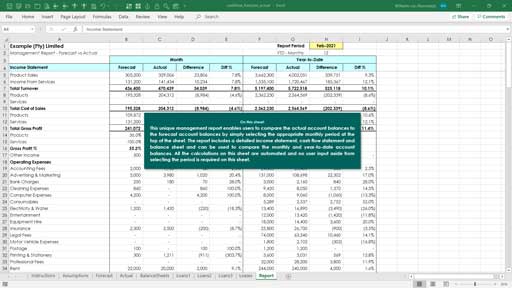

Income Statement Template

Use this income statement template to assess profit and loss over a given time period. This template provides a clear outline of revenue and expenses along with net income figures. You can edit the template to match your needs by adding or removing detail, and create an income statement for a large or small business.

Download Income Statement Template

Excel | Smartsheet

Simple Cash Flow Template

This template works for any length of time and allows you to compare different periods for a quick analysis of cash flows. It include sections for an itemized list of revenue and expenditures, automatic calculations of totals and net cash flows, and a simple layout for ease of use. You can modify the template by adding or removing sections to tailor it to your business.

Download Simple Cash Flow Template

Excel | Smartsheet

3-Year Cash Flow Statement Template

Use this statement of cash flows template to track and assess cash flows over a three-year period. The template is divided into sections for operations, investing, and financing activities. Simply enter the financial data for your business, and the template completes the calculations.

Download 3-Year Cash Flow Statement Template

Excel | Smartsheet

Monthly Cash Flow Template

This comprehensive template offers an annual overview as well as monthly worksheets. Create a detailed monthly cash flow report to analyze performance or plan for the future. Each month has a separate sheet so that you can get a thorough picture of cash inflows and outflows for both short- and long-term periods.

Daily Cash Flow Template

Add receipts and payments to this daily cash flow template to get a deep understanding of business performance. You can customize the list of cash inflows and outflows to match your company’s operations.

12-Month Cash Flow Forecast

Use this template to create a cash flow forecast that allows you to compare projections with actual outcomes. This template is designed for easy planning, with a simple spreadsheet layout and alternating colors to highlight rows. You get a snapshot of cash flows over a 12-month period in a basic Excel template.

Download 12-Month Cash Flow Forecast

Excel | Smartsheet

Quarterly Cash Flow Projections Template

Cash flow projection templates can cover a variety of time frames, including the quarterly format offered here. Quarterly projections are useful for new businesses and those wanting to align cash flow projections with upcoming goals and business activities. Use the template to create projections and then compare the variance between estimated and actual cash flows.

Cash Flow Analysis Template

You can use this template to perform a cash flow sensitivity analysis in order to anticipate shortfalls and help your business maintain a positive cash position. This analysis can help you make more accurate cash flow predictions and inform your business decisions.

Cashflow 101 202 Excel Spreadsheets Tutorial

Discounted Cash Flow Template

This template allows you to conduct a discounted cash flow analysis to help determine the value of a business or investment. Enter cash flow projections, select your discount rate, and the template calculates the present value estimates. This template is a useful tool for both investors and business owners.

Nonprofit Cash Flow Projection Template

This template is designed with nonprofit organizations in mind and includes some common income sources, such as donations and grants, as well as expenditures. The template covers a 12-month period and makes it easy to see annual and monthly carryover so that you can track a rolling cash balance. Create a detailed list of all receipts and disbursements that are relevant to your organization.

Personal Cash Flow Template

Individuals can manage their personal cash flow with this free template. The simple layout makes it easy to use and provides a financial overview at a glance. Keep track of how you are spending money to gain more control over your financial habits and outlook.

Trial Balance Worksheet

Use this trial balance template to check your credit and debit balances at the end of a given accounting period, and to support your financial statements. The template shows ending balances for specific accounts, as well as total amounts for the activity period and the overall difference. This is a simple worksheet that you can customize to reflect your business type and the products or services it offers.

Download Trial Balance Worksheet

Excel | Smartsheet

A More Collaborative Cash Flow Statement Template in Smartsheet

Using a template is essential to helping you get started managing your organization's financials quickly. But, creating and managing your cash flow statement may require multiple stakeholders to weigh in and make updates. That’s why it’s important to find a template with more advanced functionality like notifications and reminders and enhanced collaboration features to ensure everyone is kept in the loop. One such template is the cash flow statement template in Smartsheet.

A Smartsheet template can improve how your team tracks and reports on cash flow - use row hierarchy to sum line items automatically, checkboxes to track stakeholder approval, and attachments to store item details directly to the rows in your sheet. Easily create reports to roll up annual, quarterly, or monthly cash flow details so you’ll always have a real-time view of the financial health of your business.

See how easy it is to track and manage your cash flow statement with a template in Smartsheet.

A Better Way to Manage Accounting and Finance Processes for Companies of All Sizes

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.